Burr: Cancelling Extraordinary Amounts of Student Loan Debt ‘Wrong Solution’ for Borrowers, Taxpayers

Today, the Senate Health, Education, Labor and Pensions (HELP) Committee held its nomination hearing for James Kvaal to serve as the Under Secretary of the U.S. Department of Education.

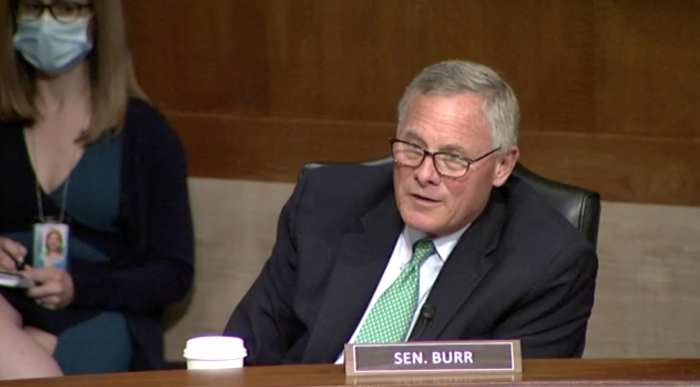

In his prepared opening remarks, Senate HELP Committee Ranking Member Richard Burr (R-NC) underscored his disapproval of massive student loan debt forgiveness and offered his legislation, the Repay Act, as an alternative and sustainable bipartisan policy solution that simplifies repayment options for borrowers by establishing one easy-to-navigate income-based repayment plan.

WATCH: Ranking Member Burr delivers opening remarks before the nomination hearing for James Kvaal to serve as Under Secretary of Education.

Excerpts:

“I want to be clear about some worries I have about proposals by some of my colleagues on the other side of the aisle, as well as suggestions within the Biden Administration, to cancel extraordinary amounts of outstanding federal student loan debt.

“I firmly believe this is the wrong solution to what I think most of us agree are challenges faced by many current and future student loan borrowers.

“The Higher Education Act – or HEA – was enacted in 1965. Are we supposed to believe that for the last 56 years that the HEA has been in place, the Secretary has been able to cancel vast amounts of debt for every single borrower in the United States this whole time and we just didn’t know about it until now?

“Mr. Kvaal, I must be honest with you and with everyone else on this Committee: this does not pass the laugh test.

“Importantly, I believe the negative implications of unilaterally cancelling outstanding federal student loan debt would be more than enough to deem this bad policy.

“For starters, this has a one-time cost of as much as one trillion dollars shifting that burden onto unsuspecting taxpayers. It’s also a regressive policy, meaning it will benefit the rich, mostly people who will already earn more because of their college education. It would be a huge gift particularly for Americans with student loan debt from graduate school who disproportionately earn higher incomes. It is also a very poorly targeted use of federal resources that does nothing to benefit the more than 200 million Americans that do not have federal student debt and never attended college. Finally, the promise of cancelling mass amounts of student loan debt creates a significant moral hazard.

“So, we know what will happen if we cancel tens of thousands of dollars of student loan debt for individual borrowers. What will stop schools from raising tuition higher and higher and digging an even deeper debt hole? Without institutional accountability, will you be asking the American taxpayer to foot another loan forgiveness scheme every 5, 10, 15, 20 years? Where does it end?

“In addition to asking colleges and universities to play their part to stem this debt spiral, I have a better idea for loan repayment. A few weeks ago, my colleague Angus King and I reintroduced the Repay Act.

“Instead of making students choose between nine unique loan repayment plans, our plan would allow borrowers to choose between two simple plans.

“The first is what most borrowers already pay now: a fixed, 10-year repayment option. The second is a Simplified Income-Driven Repayment Plan. It simultaneously accounts for how much a student borrowed, and how much they currently earn.

“I believe the Repay Act is a commonsense solution to our over-complicated student loan repayment system. It’s fair to students and fair to taxpayers.

“Mr. Kvaal, if confirmed, I would look forward to working with you on this pragmatic bipartisan solution and others, and I hope you would do the same.”

To read Ranking Member Burr’s full prepared opening remarks, click here.